Collusion occurs when firms do not operate independently, but they cooperate. The collusion may stem from unstable markets or risk avoidance. Practically, firms make an agreement on the output, price or employ other restrictive trade practices (such as price fixing etc.). Collusive behavior can lead to the situation similar to "a single monopolist behavior" on the market. Further, think about telecom market in Ukraine and the one in Canada.

First, look into Ukrainian market. There are three mobile operators in Ukraine: MTS, Kyivstar, and Life.

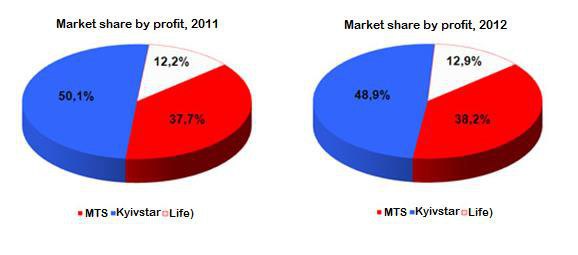

From the first graph you can see the market share by profit of each player in 2011-2012 (Ukraine).

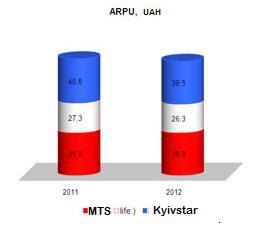

The second graph shows the average revenue per user in UAH for 2011-2012 year.

Kyivstar and MTS set up roughly the same service tariffs while Kyivstar has bigger market share and better level of network coverage. Once the new player Beeline entered the telecom market but after a while was conjoint to Kyivstar that shows the oligopolistic market vector. Life penetrated the market with dumpling tariffs and snipped off a piece of the market. However, later the low level of service quality and the greed which led to higher prices on service had resulted in the loss of competitive advantage. The good thing Life made Kyivstar and MTS had lowered their tariffs in order to save customer loyalty. To remain on the market Life was forced to push its tariffs back to the low level. As a result, the Life service remains undergrade, and market share by profit is still small.

Overall, the telecom market in Ukraine is saturated, resulting in a fierce competition for existing customers between three main cellular service providers. This leads to lower prices and the aspiration for advanced mobile technology (3G/LTE) development, which would offer the Ukrainian customers innovative services based on mobile data and helps mobile operators enhance their competitiveness.

Perhaps, you recognized the model of this market which is the Cournot.

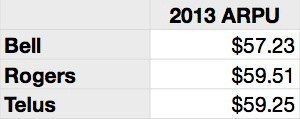

Second, consider the Canadian market. The Canadian telecommunications industry today is ruled by the three mega giants: Rogers Communications, Bell Canada and Telus which together holds the majority of the market.

They set up very high prices for their services; nonetheless didn’t try to improve their service (for the purpose of minimizing costs). Just 15% of the country is covered by mobile services. Operating costs on revenue was 69% in 2002 in Canada versus 52% in 2007 and remains low.

It is obvious that companies behave as one monopolist in the marker setting up same high prices and not trying to highly invest in the telecom infrastructure for gaining prospective advantageous conditions for gaining new customers. Such the behavior is called collusive as you should have understood from the definition given above. The formal agreement is called a cartel and the practices of cartels are under legal restrictions and are being identified and broken up by institutions executing competitive policy which will be discussed later.

The question is why there is an oligopoly and how to deal with it?

There are different reasons for the oligopoly existence. Market structure in telecommunications is defined by several basic elements such as Seller concentration, Cost structure, Barriers to entry and Network Externalities.

High fixed costs are typical for telecommunications as the industry is very demanding in terms of innovations and technologies. Considering a cost structure, telecom market is characterized by relatively low marginal costs, which are independent from the number of subscribers using the network. Moreover, costs are often sunk as the initial investments are specific and very expensive. Presence of high sunk costs results in high exit barriers. Thus, companies in order to survive needs to set prices higher than marginal costs are. In fact, mobile operators in Canada exercise their monopolistic power (collusive behavior) by setting up too high prices and cutting fixed costs. The quality of service leaves something to be desired.

The presence of entry barriers in mobile networks is very significant due to the scarcity of spectrum and licensing of the regulatory agencies. Frequency spectrum is controlled by government and operated through legislations. To enter the market the spectrum must be available on the market, so number of licenses issued is very limited and it makes entry more difficult.

The presence of switching costs is another factor that possibly increases the barriers. Existence of switching costs allows consumers to switch from one operator to another one, but it is costly. Indeed, the main issue why Canadian cellular service providers can exercise their power as the monopolistic one is lay in great switching costs. To switch to another cellular service provider one has to buy a new mobile phone from the cellular service provider. Otherwise, mobile phone will be either locked (you can’t use the mobile network) or costs you a fortune.

There are really few models of phones that are unlocked, yet you still should sign a contract with one of mobile operators, which won’t give you satisfying conditions while being afraid of losing your loyalty. On the contrary, in Ukraine the practice of tying the mobile phone to a contract with individual mobile operator failed to find its development. This may give a point why Ukrainian telecom market is pressed for competitive version of oligopoly, whereas Canadian one is more monopolistic.

To prevent the market from oligopolistic benefit behavior the government implies the regulations. The most important is the regulation of the maximum price for calling from one network to another one. The same policy was implemented for the roaming services as well.

Actually, in summer 2012 the Antimonopoly Committee of Ukraine actively fought for the tariff reduction in mobile communications. The objects of concern were mobile operators Kyivstar and MTS Ukraine, whose tariffs AMC recognized economically unjustified and demanded to make them lower.

Another way for the government to intervene is by an increase in competition. Indeed, the Canadian government licensed two additional companies – cellular service providers – Microcell (Fido) and ClearNet, and provided them with advantageous conditions to increase competition on the market. However, the two new licensees, Fido and ClearNet were obviously struggling, despite rules giving them a startup advantage, and they were relatively quickly swallowed up by Rogers and Telus respectively (two oligopolistic players).

Yet later the government made another attempt to introduce more competition, and licensed Wind, Mobilicity and Public Mobile, again with special conditions, but, having learned from the Fido / ClearNet experience, they included a caveat that prevented the new licensees from selling their spectrum to the three other incumbents. Wind, Mobilicity and Public Mobile provide inexpensive plans for the consumers, but at the same time their service quality is even worse than the “big three” one. Nowadays they are struggling, and looking for a rescue before they run out of cash / credit. So twice the government has tried to introduce competition, and twice, despite providing advantageous conditions, they have failed.

As we have seen, there are two different oligopolies of telecom market. One is rather competitive, whereas another one is rather monopolistic. This might be due to different historical developments of the markets, government policies, and technological issues.

Anastasiia Zarubina, the KSE student.